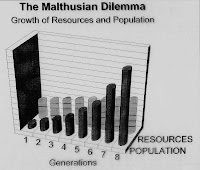

They call economics the “dismal science.” The term was coined by the 18th Century Scottish Philosopher Thomas Carlyle in response to the economic theories of the Reverend Thomas Malthus. Malthus was an early economist who predicted that mankind would starve to death because population growth would far exceed the growth of food production. According to the “Malthusian Theory,” population would grow geometrically while food production would only grow arithmetically eventually leading to the “Malthusian Catastrophe” of worldwide starvation.

Arithmetic Progression 1, 2, 3, 4, 5, 6, 7, 8

Geometric Progression 1, 2, 4, 8, 16, 32,

Malthus’ theory was wildly popular in its day. It was embraced as an obvious and inescapable truth. It was also, as we now know, wrong. It turns out that civilization learned how to increase food production at a rate that far exceeded population growth. Innovation won out over pessimism.

The Holy Roman Empire was neither holy, nor Roman, nor an Empire.

In most instances economics is neither dismal, nor a science. It is at best an inexact science and at worst a collection of flawed competing theories. These flawed theories get trotted out before an eager public anxious to embrace again the most dismal predictions during times of economic turmoil. Currently, one of the prophets of disaster making headlines is Peter Schiff. Known as “Dr. Doom,” Schiff is the son of the well-known tax-anarchist Irwin Schiff. “Dr. Doom” predicts that the US economy will collapse because of the lack of a manufacturing base coupled with rampant consumption. Schiff, who served as economic advisor to Presidential candidate Ron Paul, has been predicting this disaster for the last 20-25 years and his fans argue that he is now finally being proven right. Most serious academics dismiss Schiff’s theories as “Malthusian.”

We are enjoying sluggish times and not enjoying them very much.”

- George H. W. Bush -

Are we in a recession? As with all things economic, it turns out there are two competing theories. According to the traditional view, we won’t know until late February or early March of next year when we find out for sure that we experienced an economic contraction in the fourth quarter of this year. According to a second theory, we have been in a recession since December of 2007. The National Board of Economic Research made this announcement two weeks ago. Since most of us have known intuitively that this is a recession, I like the second theory. The different standards demonstrate a truth about economics: economists tend to tell us about economic cycles after-the-fact and not before.

How long will this recession last and how bad will it get? Since the end of World War II, the average recession has lasted a little over 10 months. The two longest recessions have both been about 16 months. The greatest economic contraction occurred in the first of these two long recessions beginning in 1973. The largest unemployment rate, 10.8% occurred during the second of these beginning in 1980.

Most experts are telling us this will be the worst recession since World War II. While almost undoubtedly true, this dire warning ignores the fact that post-WWII recessions have generally been mild compared to pre-WWII recessions. Pre-World War II, the average recession lasted 21.2 months. Post WWII recessions have lasted only half as long on average. Since the worst recession of the last 60 years lasted only 16 months, this recession only needs to last another 4 months to become the longest.

Average Length of US Recessions

Post-World War II 10.4 months

Pre-World War II 21.2 months

How will we know this recession is over?

Because of the way these things are reported, the economists will not notify us that the recession has ended until way after the fact. Not surprisingly, the best indicator that the economy is entering or exiting a recession is the stock market. About half the time, when the market declines 10% or more, we are entering a recession. 100% of the time, the stock market heralds the end of a recession with an advance that begins typically 6-9 months before the recession ends. Another signal to look for is a decline in the monthly increase in unemployment filings.

Slaying the Dragon

Economists disagree on how to fight a recession. Keynesian economists suggest that deficit government spending will re-inflate the economy. Supply-side economists suggest that lower taxes will spur corporate investment. These two competing theories go a long way towards explaining the political rhetoric dominating the American landscape today. I am a Keynesian. I like deficit spending. I also like lower taxes. One thing is certain, the Hoover administration created the Great Depression by raising taxes, tightening credit, and slashing government spending.

Different Approaches to Fighting a Recession

Keynesian economists deficit spending

Supply side economists lower taxes, especially corporate tax rates

Laissez-faire economists no government action

Populist economists direct payments to consumers

The Reagan Revolution

Supply-side economists point to Ronald Reagan’s success in ending what “was” the worst recession of the post-WWII era as a victory for tax cuts and the “trickle-down theory.” That argument misses the mark. The real credit should go to Reagan’s substantial deficit spending on defense. Reagan spent billions on defense; star wars, stealth bombers, Abrams tanks, and my personal favorite; refurbishing World War II battle ships to serve as platforms for the new cruise missiles. Reagan increased the federal deficit and defense spending at a record rate. He also created 2.8 million new jobs, the greatest bull market in history, and nearly two-decades of unprecedented prosperity. Take it from the “Great Communicator,” deficit spending works!